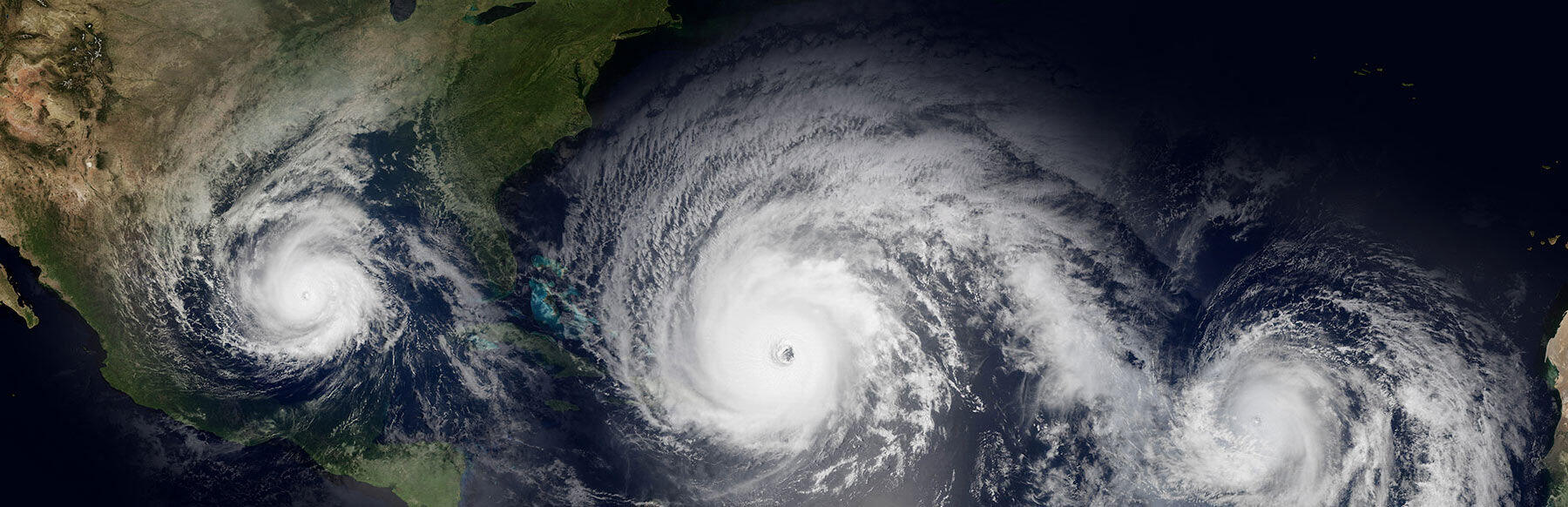

Florida, the sunshine state with its endless beaches, is a coveted paradise for many to live and vacation. However, this beautiful state is also subject to the fury of hurricanes, which can leave a devastating trail of destruction in their wake. In times of crisis like these, having the right assistance can make the difference between a successful recovery and months of frustration. This is where the crucial role of a Public Adjuster in cases of hurricane damage in Florida comes into play.

What is a Public Adjuster and Why Does It Matter in Hurricane Damage Cases?

A Public Adjuster is an insurance professional who works on behalf of policyholders – that’s you – to ensure you receive fair and full compensation for damages suffered during a hurricane or other natural catastrophe. Unlike insurance adjusters hired by insurance companies, the primary goal of a Public Adjuster is to protect your interests and ensure you get the reimbursement you truly deserve.

Key Benefits of Hiring a Public Adjuster:

- Expertise and Specialized Knowledge: Public Adjusters are highly trained in the field of insurance claims and are familiar with the intricacies of insurance policies. Their expertise allows them to accurately and thoroughly assess the damages incurred and calculate the true costs of repair or replacement.

- Effective Negotiation: Negotiating with insurance companies can be intimidating and overwhelming, especially in times of crisis. A Public Adjuster acts as your representative in these negotiations, advocating for your rights and ensuring you’re not taken advantage of by insurance company tactics.

- Documentation and Strong Evidence: Submitting an effective claim requires thorough documentation and strong evidence of damages. A Public Adjuster will take care of gathering all necessary evidence, from photographs of damages to expert repair estimates, bolstering your case and increasing the chances of proper compensation.

- Time and Energy Savings: After a hurricane, your focus should be on recovering physically and emotionally, not dealing with insurance claim bureaucracy. A Public Adjuster will handle the entire process, freeing you up to concentrate on what truly matters.

- Maximized Compensation: A Public Adjuster’s primary mission is to ensure you receive the maximum reimbursement possible from your insurance policy. Their goal is to ensure no damages are overlooked and they are valued fairly and accurately.

In conclusion, in a hurricane-prone state like Florida, hiring a Public Adjuster is a strategic decision that can make a significant difference in post-natural disaster recovery. Their experience, negotiation skills, and focus on protecting your interests can ensure you receive adequate compensation to rebuild your life and property. Do not underestimate the importance of having a competent ally in your corner when you need it most.

0 Comments